Understanding Property Management Fees and Charges

Ever considered handing over the reins of your rental property to a pro?

But wondering what the property management fees are.

Property management companies can be a lifesaver, but their fees can be a confusing maze.

Fear not, landlord! This guide breaks down the different fee structures (percentage vs. flat fee), exposes hidden costs, and empowers you with negotiation tips.

By the end, you’ll be equipped to weigh the cost-benefit, find the best deal, and unlock the peace of mind that comes with expert property management. Dive in and discover what property management companies charge!

Unveiling the Fee Structure: Percentage vs. Flat Fee

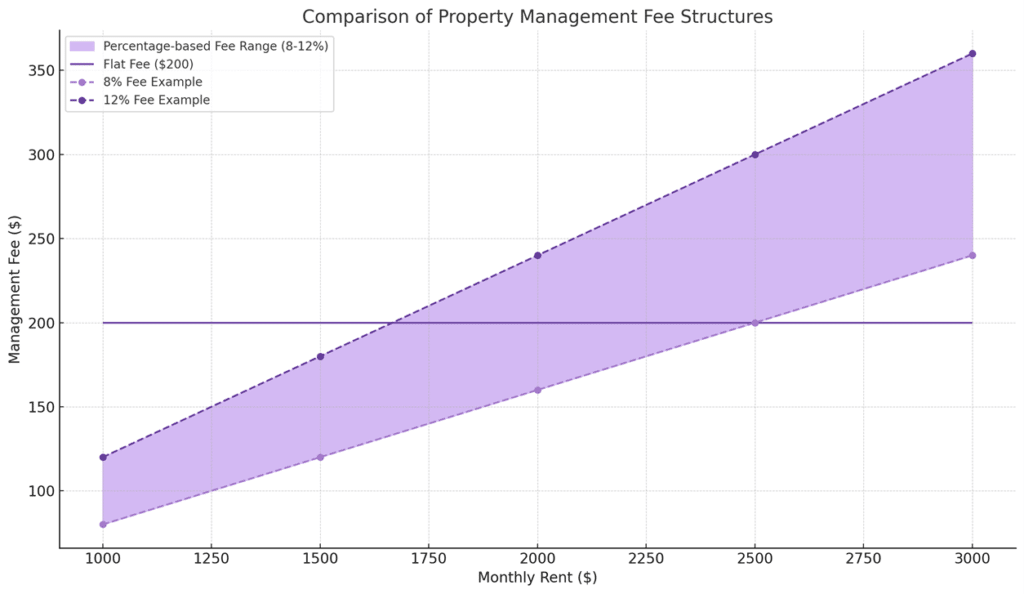

Percentage-based fees: This is the most common structure, charging a percentage of the monthly rent typically ranging from 8% to 12% of the monthly rent collected. So, for a $1,500 rent, the fee would be $120-$180. This aligns with incentives, as the property manager earns more when you do. However, higher rents translate to higher fees.

Flat fee: This offers predictability, with a fixed monthly fee regardless of rent amount. Typical fees range from $100-$250 depending on property size and services included. While attractive for high-rent properties, it might not incentivize maximizing your rental income.

Understanding the Pros and Cons: While the percentage-based fee incentivizes higher rental income, it can eat into your profits with expensive properties. Conversely, the flat fee offers predictability, but might not motivate the manager to maximize your rent. Consider your priorities and property value when choosing the right structure.

Navigating Regional Variations: Be aware that fees can vary depending on your location. Research typical rates in your area to ensure you’re not overpaying. Additionally, factor in the cost of living when comparing fees across different regions.

Beyond the Base Fee: Unveiling Hidden Costs

When it comes to evaluating your property management fees, there is more than what meets the eye. Remember, the base fee is just the tip of the iceberg. Be mindful of these potential add-ons:

- Leasing fee: Often a one-time charge for finding and screening tenants, ranging from $200-$500.

- Marketing fee: Covers advertising vacant properties, potentially a flat fee or percentage of rent.

- Maintenance markup: Some companies mark up the cost of repairs, so inquire about their policy.

- Vacancy fee: This may apply if your property remains unrented, often a percentage of the monthly rent.

Remember, it’s an Investment: Weighing the Cost-Benefit of Property Management

While property management fees might seem like a significant chunk of your rental income, it’s crucial to view them as an investment in the overall success and peace of mind surrounding your property. Consider the value they provide beyond just collecting rent:

- Time Freedom: Imagine the hours you’d dedicate to tenant screening, lease agreements, rent collection, maintenance fee coordination, and emergency responses. A property manager handles these tasks, freeing you to focus on your core business, hobbies, or simply enjoying leisure time.

- Expertise Advantage: Navigating legalities, tenant rights, and ever-changing regulations can be a minefield. Property managers possess the knowledge and experience to ensure you comply with all laws and avoid costly mistakes. They also have established relationships with contractors, ensuring efficient and affordable repairs.

- Reduced Stress: Dealing with late payments, tenant complaints, and unexpected repairs can be stressful. Property managers act as a buffer, handling these issues promptly and professionally, allowing you to maintain peace of mind knowing your property is in capable hands.

Ultimately, the decision of whether to hire a property manager depends on your circumstances and priorities. By understanding the property management fees, potential add-ons, and negotiation strategies, you can make an informed choice that optimizes your investment and brings tranquility to your rental property journey. Remember, the cost of fees often pales in comparison to the value gained through time freedom, expert guidance, and reduced stress, allowing you to truly reap the rewards of your rental property investment.

Bonus Tip💡

Consider the company’s reputation, online reviews, and communication style to ensure a good fit for your needs.

Initial Setup Fees: What to Expect

When you first sign a contract with the property management company, there are typically some initial setup fees involved. These fees cover the costs of integrating a new residential property or single-family home into the company’s management system, setting up accounts, and the initial property inspection. Expect to pay a setup fee that can vary significantly depending on the company and the services offered.

This setup fee is crucial as it allows the property manager to thoroughly prepare for taking over the responsibilities of managing your property. It includes creating detailed property listings, photographing the property, and possibly initial marketing activities to attract tenants. The fee can be a flat rate or a breakdown of one month’s rent, depending on the company’s pricing structure.

Understanding these initial costs is important as they are fundamental to establishing professional handling of your property, ensuring everything from the rent due vs rent collected processes to tenant communications is set up effectively from the start.

Technology and Property Management: Efficiency vs. Costs

In an era where technology infiltrates every aspect of business, property management companies have also embraced innovative tools to enhance their efficiency and service quality. From digital platforms for tracking rent due and rent collected to automated systems for handling lease renewals and maintenance requests, technology plays a pivotal role in modern property management.

However, the adoption of technology in property management raises questions about how it impacts overall property management costs. On one hand, technology can lead to cost savings by automating routine tasks, reducing the need for extensive manpower, and speeding up response times, which can be particularly beneficial for managing single-family homes and other types of residential properties. These efficiencies might reduce the overall cost of property management services for landlords.

On the other hand, the initial investment in cutting-edge technology and the ongoing maintenance of these systems can lead to higher fees. It’s also wise to consider if these technologies bring enough value to justify the costs, such as more accurate and timely collection of rent, enhanced tenant screening processes, and more efficient handling of maintenance issues and eviction fees.

Moreover, technology can impact the tenant placement fee by streamlining the process, potentially lowering costs associated with tenant turnovers and vacancies. This can be particularly advantageous when the breakdown of one month’s rent as a placement fee can add up over time.

Owning rental property is like having a child – except it hopefully pays its rent and doesn’t need braces

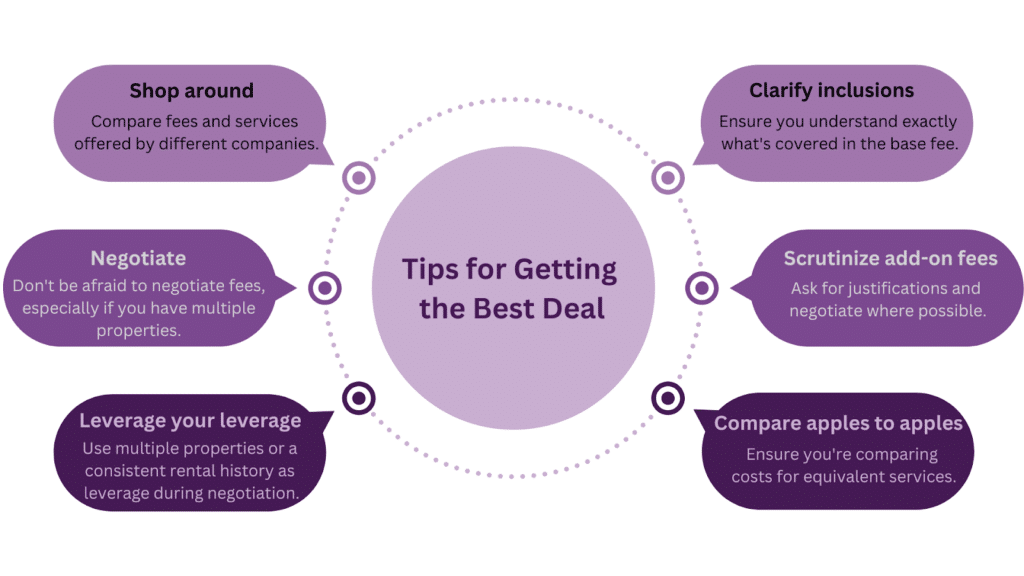

Navigating the world of property management fees can feel daunting, but armed with knowledge and negotiation skills, you’re empowered to make informed decisions. Remember, the ideal fee structure and services depend on your unique needs and priorities.

Research, compare, and negotiate with confidence, focusing on finding a company that aligns with your values and offers transparent pricing models. By viewing property management as an investment in time, expertise, and peace of mind, you can unlock the true potential of your rental property and enjoy the journey toward financial success.

So, take the plunge, explore your options, and discover the perfect property management partner to guide you on your rental property journey!